In order to be financially successful, you must be free of credit card debt. Paying only the minimum amount due on credit cards will get you nowhere.

If you’re short on money, pay the minimum amount until you find extra money. It can mean selling stuff, such as electronic items, jewelry, or musical instruments.

Figure out a way to earn extra income or cut down expenses. Once you’re ready, follow the steps below.

Start paying off your debt with this 7 step plan to pay off credit card debt.

1. Know how much you make per month.

First and foremost, you need to know how much money is coming in each month, whether it’s from your job, your spouse’s job, unemployment insurance, etc. Track the exact amount after taxes.

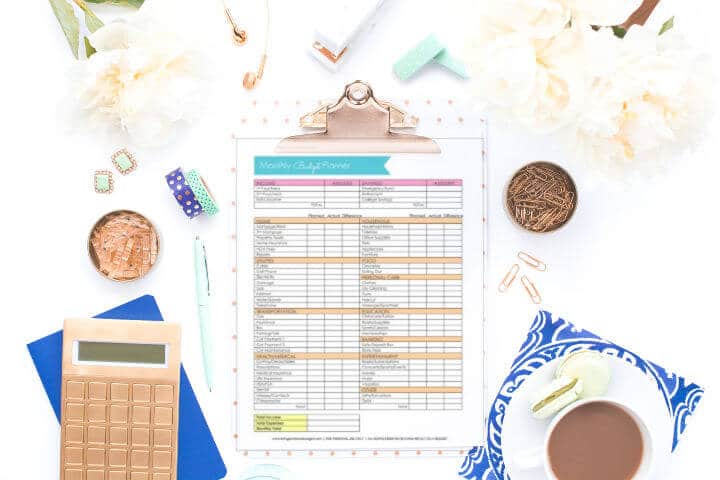

2. Set up a monthly budget.

Spending more than you make is easy without a budget. You need to know exactly where your money is going. Track expenses for a month.

Then set up your budget accordingly with this Budgeting 101 Guide. Make sure your monthly budget does not exceed your monthly income. Don’t forget to set aside money to pay off debt.

3. Cut unnecessary spending.

Cooking at home can instantly cut costs. Eating out is expensive and can add up quickly.

On average, a couple can easily spend $20 – $30 on eating out at a restaurant. By cooking meals at home, you can bring down the cost to about $2 – $3 per person.

What other ways can you reduce spending? Can you cut cable TV or change phone services?

4. Track your debt.

If you don’t know the exact amount of your debt, the interest rates on your credit cards and loans, the minimum payment amount, or payment due dates, then you cannot begin to make a change.

Put all of your credit card and loan info onto an Excel spreadsheet. If you are low tech, use a piece of paper.

Keep track of every loan and credit card, the current balance, the interest rate, minimum payment, and the monthly due dates. Refer to this sheet every week to keep track of payment due dates.

5. Stop using your credit cards.

If you can’t pay the full amount on your credit cards every month, stop using your credit cards! If you carry a running balance on your credit card, any additional purchases will be assessed a finance charge right away.

In fact, you will be charged a finance charge the same day you make a purchase, every time! You will not receive a 20 day grace period for any purchases (like you do when you pay in full by the due date every month).

You don’t need to incur anymore debt than you already owe. Try to use cash for purchases. Also, don’t use the cash advance checks that come with your statement. Interest on cash advances can be 20% and up. Don’t dig yourself into deeper debt. Dig yourself out!

There’s also the problem of not having enough cash on hand to use. You’ll have to figure a way to get extra cash either by selling stuff or earning extra money. Do what you can.

6. Pay off debt in collections first.

If you have bills from a collections agency, then pay this debt off first. Debt in collections will lower your credit/FICO score.

A low FICO score lowers your chances of being able to rent an apartment, get a cell phone, and qualify for a mortgage loan with a good interest rate. As a result, having a low credit score affects everything in your life. The good news is that you can improve your score by paying off any debt in collections.

7. Pay off the credit card or loan with the lowest balance or highest interest rate.

Gather all of your credit card info – current balance, minimum payment, and interest rate, per card. If you’re bad at math, don’t worry, here is a wonderful free tool that will calculate how long it will take to pay off your debt.

Should you pay off the card with the highest interest rate or the one with the lowest balance? There’s two schools of thought here.

I’ve done both and I have to say that if you have multiple credit cards, getting rid of one card is liberating. Once it’s paid off, you don’t have to track that card anymore and there’s one less payment to make each month. It’s one less thing to worry about.

On the other hand, sometimes you have a loan or credit card with a crazy interest rate. We had one that was $250/mo. for just interest alone! Obviously, we couldn’t pay that off first, but when a windfall of money came along, you bet I paid that sucker off!

It’s up to you. Do whatever works best for your situation.

You can enter multiple credit cards and loans. Enter your balance, interest rate, and minimum payment.

For the interest rate, for example, if it is 22.9% enter “22.9”. It will automatically give you a debt payment plan without you having to use any brain power. Click here for CNN Money’s debt calculator.

Enter the amount you can afford to pay towards your debt each month or your debt free deadline, in years and months, and it will figure out how much you need to pay every month to reach your goal. The debt calculator will apply more money to the credit card or loan with the highest interest and recommend that you pay the minimum payment on the remaining cards.

Seeing the whole picture of how long it will take to pay off all of your debt is liberating in a way. It takes away the fear of the unknown. Soon you will be debt free and that’s a wonderful feeling. Plan some sort of celebration when you pay off your debt!