Are you trying to budget better or even start a budget for the first time? So glad you’re here!

A budget is simply a spending plan so you know where your money is going.

First, here’s the link to Dave Ramsey’s Free Guide to Budgeting.

FYI: The Dave Ramsey site now requires an email to receive their free budgeting guide.

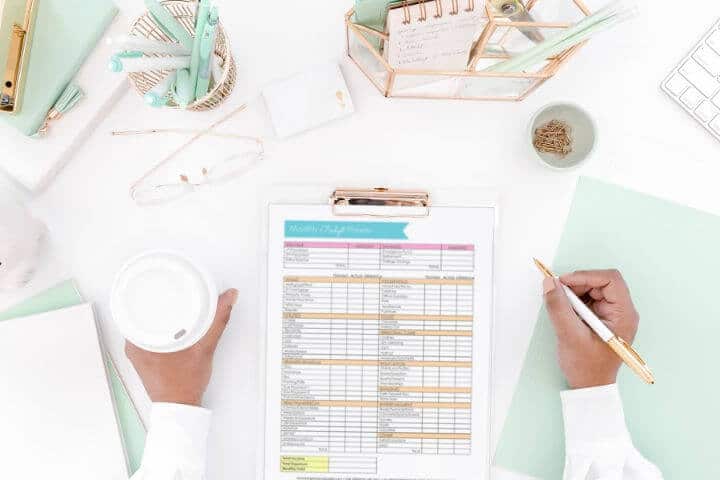

When you’re ready to start your budget, check out my budget binder below.

I created Budgeting Made Easy, my budgeting ebook and printables, so that I would stay motivated with sticking to a budget.

Pretty things spark joy for me. Thanks, Marie Kondo! And if I associate joy with budgeting, I will follow through.

This is a quick start guide to starting your first budget.

1. What are your goals?

First things first. What are you trying to accomplish with a budget? Are you trying to pay off debt, save up for a house, put money into a savings account, or catch up on bills?

Once you figure this out, then you know how to focus your budget.

Are you making a budget with a significant other? Check out these 5 Secret Money Management Tips for Couples.

2. Calculate your income.

How much do you make after taxes? Do you have side jobs or work for yourself?

3. List your monthly bills.

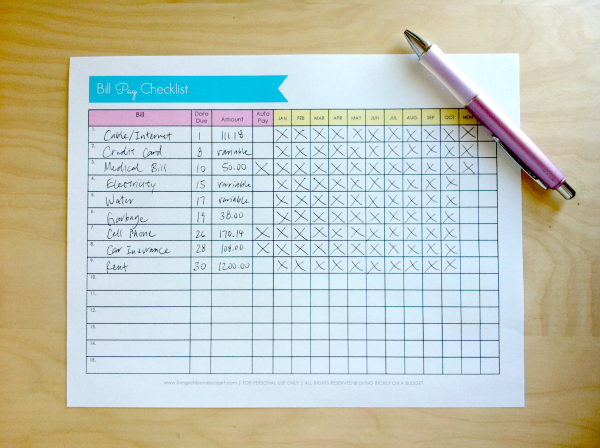

What bills happen every single month, like cell phone, Internet, car loan, etc. You need to know this and have it all in one place.

4. Track those bills that happen a once a year or a few times a year.

These are the ones that get most people by surprise. Look ahead and be prepared for them. Here’s how to use a Bill Pay Checklist.

5. Look at your expenses for the past 3 months.

See how much you have spent on eating out, groceries, clothes, and everything else. You’ll be surprised at how much you spend on little things like a trip to Target.

Don’t forget these common budget categories to include in your budget worksheet.

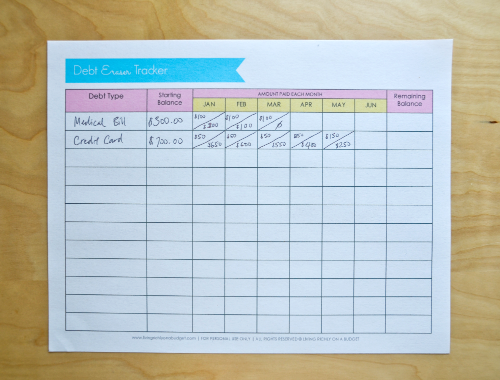

6. List all of your debt.

Debt is not a fun thing to think about. But if you don’t think about it, it will grow and balloon out of control. Knowing how much you owe and understanding what the interest rate means will help you gain control over it.

Then you can plan how you will pay it off. And having a plan is huge! It will help you stop worrying about it and help you stop feeling guilty.

7. Plan what you’re going to focus on.

Now that you see the full picture, decide on what your priorities are. This is easy now since you thought about it during the first point, about what your goals are.

If you’re paying off debt, then focus all your energy on that.

Learn how to create a budget binder to organize it all!

Need more help?

Check out Budgeting Made Easy, my 56-page budgeting guide, which includes these cute printables, below. Also, check out my digital budget planner, Budgeting Made Easy Digital.

You might also like:

The 2021 Budget Binder That Will Transform Your Finances