For college students, it’s the first time you’re going to be away from the umbrella of your parents. It’s the first time, you’ll be offered a T-shirt or some other cheap “gift” to open your first credit card.

It’s the first time you join a fraternity or sorority to build lifelong friendships. But do you know all the costs involved?

What you do now will affect your financial future later. As corny as it sounds, it’s true.

You might think that you’ll find a great paying job right after college and be able to pay off things. Sometimes that does happen. Most times, especially in this tough economic time, it may be years before you find a well paying full-time job. And you might not even like that job!

Are you going to fall into a money trap and start going into debt or will you be prepared?

7 Money Traps to Avoid

1. Credit Cards

Many, many years ago, when I was in college, I came across a booth outside of the student union, that was giving away a free T-shirt. I passed this booth several time a day.

And I wanted a free T-shirt. I mean who doesn’t love free T-shirts, even if they don’t fit or you would never wear them. So I did it. I signed up for my first credit card there.

In my mind, I wanted to start a credit history, be responsible, and feel like an adult. I was able to pay off my balance every month because I had a part-time job and it was ingrained in me since I was a child to manage my money carefully.

Unfortunately, this is where lots of people get into trouble. They get their first credit card and spend, spend, spend. And they never look at the statements or keep track of the due dates. Or they don’t have enough money to pay it off in full, which incurs finance charges.

Then they’re screwed, for years. Don’t let this happen to you (or your kid who’s going to college). When you get a credit card, know that it’s not free money. It’s responsibility.

You have to pay in full every month or you lose your 30 day grace period. And once you lose it, it’s very hard to get it back.

Lesson: When you open a credit card, make sure you have a job or income to pay for your purchases. Otherwise, don’t do it!

2. Student Loans

My parents didn’t save up money for me to go to college but luckily, I went to a state university, which was fairly affordable back then. I did have to take out a loan to pay for some of my tuition and books.

I borrowed the least amount that I could get by on. They offer you a lot more though. One of my friends, borrowed more to have extra money. When she graduated, she owed twice the amount that I did.

Even though I didn’t borrow that much, it was still overwhelming to receive loan repayment letters after I graduated. And, it was hard for me to find a full-time job right away.

Even at that amount, I didn’t think I could pay it off in the near future. Finally, I was able to pay it off with part of an inheritance. The enormous burden of owing thousands of dollars was lifted. I know most people owe more than I did but still, it was a heavy burden to carry.

Lesson: Borrow only what you need.

3. Textbooks

When I was in college, the Internet just started becoming popular. I mean I’m talking about getting my first e-mail account at school and dial-up modems. What?

E-mails were in DOS format. And I had to enter command scripts to log into my e-mail.

I had to buy used textbooks from the school bookstore. They were expensive! One friend photocopied all the pages of our textbook so others didn’t have to buy it!

Now you can rent textbooks instead of buying! Check out:

Lesson: Rent your textbooks.

4. Housing

Since I went to college closeby, it was literally across the street from my high school, I lived at home, rent-free. I didn’t even own a car as I took the bus to school and sometimes biked there for exercise. Hey, I lost so much weight doing that!

According to U.S. News, the average cost of room and board is $15,000! Wow! If you’re in high school, looking at colleges, think about this when you’re choosing a school.

If you live off campus, share a house to split rent. The more people, the lower your rent will be.

I know it’s not an option for many or you might not want to do it, but going to a nearby school and living at home will save the most amount of money. I still loved my college experience and met many wonderful people who are still my friends, while I still lived at home.

Lesson: Save on housing expenses by going to a local college and living at home.

5. Eating and Hanging Out

In college, there are endless opportunities to hang out with new friends. There’s also endless opportunities to spend a lot of money, especially on food and entertainment.

If you share a house or apt, one thing you should do in college is to learn how to cook! It will save you so much money to cook on your own vs. going out. Invite friends to come over instead of going out. Or at least have an eating out budget set. Stuff like this adds up quickly.

If you live in a dorm then you have the meal plan. Stick to the meal plan and limit eating out.

Lesson: Learn how to cook for yourself. You’re an adult now!

6. Drinking

Drinks cost an average of $5 – $20 depending on whether you’re at a bar, restaurant, or club.

I wasn’t much of a drinker in college and I’m still not, which is great because I save a lot of money that way! Not only will it save you money but you will be in control at all times. And that’s important especially if you’re a female.

If you do plan to drink, be responsible. Designate a sober driver and a trusted friend to watch over you if you get drunk.

Lesson: Don’t drink or at least know your limits.

7. Fraternities and Sororities

Part of the college experience is joining a fraternity or sorority. I wasn’t part of one but my best friend was.

When you join, you probably don’t think of the cost of formals, clothes, gifts, and events. Some people spend thousands of dollars. Check out a breakdown at Budgetsaresexy.com.

Lesson: Know the real cost before joining a fraternity or sorority.

What to Do:

1. Get a part-time job.

First things first. If your parents are paying for college, great! But don’t take advantage of them. Now is the time to start an employment history and get real life work experience. It’s even better if you can get a job working in your field.

If you don’t think you have time, then think like this. If you have time to be on Facebook, Twitter, or Instagram, you have time to work at a part-time job.

2. Start a budget.

You need a budget. End of story. If you want to be rich someday, you need to budget.

Budgets help create financial freedom. Budgets help you stay on target and reach your goals.

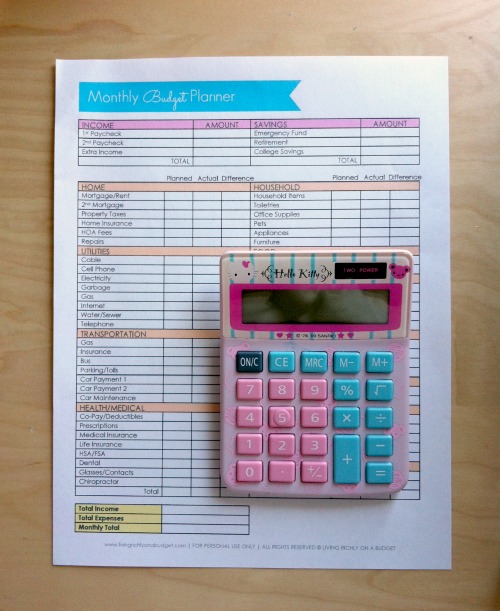

Start by calculating monthly expenses and things that come a few times a year, like car insurance. You can get started quickly and painlessly with this Monthly Budget Planner, which is part of my Money Management Kit.

Once you see what’s happening for a few months, you can project what you will spend in future months. When you can plan, then you can starting creating your financial future.

It lists expenses that most people have. There’s also an option to customize your budget.

3. Track expenses.

Tracking expenses is an important part of budgeting. It can be as simple as jotting down daily expenses in a log or a Daily Expense Tracker.

Or save all your receipts and do it once a month. I think this is harder to do and overwhelming.

4. Keep expenses low.

After you start a budget and track expenses, you will start to see where you’re wasting money.

Learn to be frugal. Learn how not to spend money and instead save money.

Again, be mindful that how much you spend in college has a lot to do with your financial freedom after college. Get into debt now and you’ll be in debt after you graduate.

Rack up student loans and credit card debt now and pay for it later – 10 or 20 years later!

5. Start investing NOW.

The one thing I wished someone told me when I was in college was to start investing. Hello! Time is on your side.

Want to be rich one day? Invest your money.

Everything that you invest now, even a few hundred dollars to thousands of dollars, will grow in your favor. That means you can invest less money than a person 10 – 20 years older than you and still have more money than them when you retire.