Money management is notoriously challenging for couples but definitely easier to handle if you’re by yourself. Add your significant other and it can spell disaster.

When I was single, dealing with finances was simple. And I naively thought that they would stay that way when I got married.

But during the first year of marriage, I was in for an unpleasant surprise. My husband and I had different views about money and they clashed, of course.

Opposites attract. But when it came to money, our views didn’t clique. Whose does?

Most couples have a tightwad while the other is a spender. Without the tightwad, you’ll never save. Without the spender, you’ll never go on vacation.

So both balance each other out and that’s important. Also, some people have trust issues when it comes to money. Money is tied to different emotions – fear, love, guilt, comfort.

I had to learn how to communicate better about money without involving emotion or starting a fight. It’s still a struggle but I’m learning every day.

Suze Orman covered these secret money management tips for couples on her TV show. And she’s so on point.

1. Pay bills together.

In most situations, one person pays the bills, while the other is not involved and is more carefree about spending. Am I right?

If you’re reading this, you’re probably the one who pays the bills!

Paying bills together helps you stay on the same page. It’s a challenge to start but once you do, it’s worth it.

The data is in front of you and there’s nothing to hide. When you both see the bills, you’ll both be mindful of how much things cost and why you have to stay on budget.

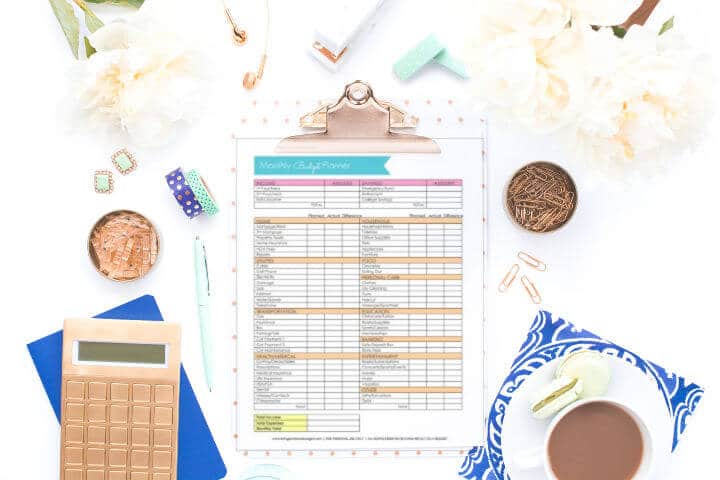

It also help to have everything organized in a budget binder.

2. Have a joint account for expenses and contribute equal percentages into it.

Everyone has their own view of individual accounts vs. joint accounts. Don’t get hung up on that.

At a minimum, have a joint account where you contribute equal percentages. Then use that account to pay the bills.

Equal percentages makes it feel more fair so that the person who makes less, doesn’t feel they’re at a disadvantage.

3. Don’t keep financial secrets.

Credit card bills and debt are easy to hide and can be a source of shame. It takes guts and courage for a person to reveal that they’re in debt.

If you suspect the other person is hiding something, be gentle and supportive. Create a positive environment so that they can trust you.

If you’re the one who’s keeping a secret, it’s time to be truthful. The longer you hold the secret, the worse it will be.

Make a plan on how you’re going to fix it.

- Does Your Budget Spark Joy?

- Free Practical Guide to Your First Budget

- Organize Your Bills Like a Boss with a Bill Pay Checklist

- Budgeting 101: How to Get Started

4. Don’t make major purchases without consulting the other.

This is huge! Agree on the amount that you’ll consult each other for, like anything over $100.

5. The person who earns the most money doesn’t have more power in the relationship.

Money equals power in business but in relationships, that doesn’t work as well. Your relationship is an equal partnership.

Want to get started budgeting together? Check out Budgeting Made Easy.

Nathan & I use the Toshl app to manage our monthly spending (the bills are on a separate spreadsheet) and it really helps us stay on target. I’m awful with numbers, but very visual so the progress bar and graphs really help me understand where we are.

Sarah,

That’s awesome!

Great post! Being financial partners is important when you are married. Both need to be involved in money decisions.

My ex told me how stupid I was about money and so he handled everything. It turned out that he was not paying the bills and made secret purchases. We were on the brink of foreclosure before I woke up and moved on. to me, fiscal infidelity is worse than marital infidelity. I quickly learned how to make and save money. Life is good.

Wow, thanks for sharing, Beth. Glad you woke up and moved on.

Great article. And for those single the best financial advice I could give someone is actually relationship advice. Your financial success greatly depends on who you chose to have by your side in life. And if your young and willing to work hard, live frugally and start investing early you can easily avoid having to work for someone in your late 40s. Wish it wouldn’t have taken me half my life to figure this out. School teaches you lessons that your tested on. Life give you test that you learn lessons from.